Committee Report recommends Digital Competition Act with ex-ante measures

The Committee compared traditional markets with digital markets to hint towards the threshold for intervention, and also looked into prevailing trends in other countries.

The Committee compared traditional markets with digital markets to hint towards the threshold for intervention, and also looked into prevailing trends in other countries.

Value of assets and turnover increased by 150% based on the wholesale price index.

by Sanjay Vashishtha† and Abhay Pratap††

Cite as: 2023 SCC OnLine Blog Exp 75

Delhi High Court observed that when assessed, by the maxim generalia specialibus non derogant or by the maxim lex posterior derogat priori, the Patents Act must prevail over the Competition Act on the issue of exercise of rights by a patentee under the Patents Act.

Coal India Limited and its subsidiary Western Coalfields Limited had contended that they cannot be bound by the Competition Act, 2002 as both are governed by the Coal Mines (Nationalization) Act, 1973. The Supreme Court held that the Competition Act applies to State monopolies, Government Companies and PSUs.

by Aayushi Singh† and Pavitra Dubey††

The Central Government appoints 18-05-2023 as the date on which the provisions of the Competition (Amendment) Act, 2023 come into force. Sections

by Vinay Sachdev*

by Shweta Shroff Chopra†, Yaman Verma†† and Neetu Ahlawat†††

Cite as: 2023 SCC OnLine Blog Exp 35

On 11-4-2023, the Ministry of Law and Justice notified the Competition (Amendment) Act, 2023 to amend the Competition Act, 2002. Key Points:

The Tribunal while upholding the impugned order passed by CCI dated 20-10-2022, set aside 4 key directions issued in paragraphs 617.3, 617.9, 617.10 and 617.7.

by Priyam Indurkhya† and Rituraj Singh Parmar††

by Vaibhav Garg† and Devansh Malhotra††

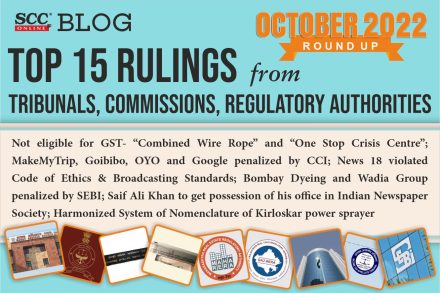

While we brace ourselves for 2023, we switch on our anamnesis mode and note down the significant decisions covered in the entire year of 2022 by Tribunals, Regulatory Bodies and Commissions

Mehul Choksi banned from SEBI for 10 years; SC acted in violation of the provisions of Constitution: CIC; No prohibition on advocate to represent different company in separate proceedings filed under Section 7 IBC; Interim directions to Gurugram Municipal Corporation vis-a-vis banned foreign dog breeds and increased cases of pet and stray dog menace; and more

Authority for Advance Ruling (AAR) Gujarat Authority for Advance Ruling| ‘Combined Wire Rope’ not a part of the fishing vessel, thus, not